8 Simple Candlestick Patterns Every Trader Should Know

8 Simple Candlestick Patterns Every Trader Should Know

Candlestick charts have been used by traders for decades to analyze market trends and predict future price movements. The patterns created by these candlesticks can provide valuable insight into the psychology of buyers and sellers, giving traders an edge in their decision-making process.

In this article, we will explore 8 simple candlestick patterns every trader should know, from the doji to the morning star. By mastering these patterns, you'll be able to spot potential trading opportunities with greater confidence and accuracy. So let's dive in and learn how to read the language of candlesticks!

1. The Doji

The Doji is a popular candlestick pattern that often signals indecision in the market. It appears as a small, cross-shaped candle with its opening and closing prices at or near the same level. This means that there was an equal amount of buying and selling activity during the trading session.

Traders should be cautious when they spot a Doji because it could indicate a potential trend reversal or consolidation period. However, it's important to remember that not all Dojis are created equal. Some may have long upper and lower shadows, which can provide additional information about price movement.

There are four types of Dojis: Long-Legged, Gravestone, Dragonfly, and Four Price. Each type has its own unique characteristics and provides different insights into market sentiment.

One way traders use the Doji is by looking for confirmation from other technical indicators or chart patterns before making a trade decision. Additionally, they may wait for the next candlestick to form to confirm whether price will continue moving in its current direction.

Understanding how to identify and interpret the various types of Dojis is crucial for any trader looking to make informed decisions based on technical analysis.

2. The Hammer and Hanging Man

The Hammer and Hanging Man are two candlestick patterns that traders should learn to recognize. Both of these patterns have a small real body, long lower shadow, and little or no upper shadow.

The Hammer is a bullish reversal pattern that forms after a downtrend. It signals that the selling pressure is about to end and buyers are starting to step in. The name "hammer" comes from the shape of the candlestick which resembles a hammer with its handle on the bottom.

On the other hand, Hanging Man is a bearish reversal pattern that appears at the top of an uptrend. It signals that sellers may be taking control as they push prices down towards their lows for the day. The hanging man has a small body with a long lower shadow and little or no upper shadow.

It's important to note that neither pattern guarantees immediate price reversals, but rather serve as warnings that changes could be coming soon in market sentiment. Traders need to carefully monitor price action around these patterns before making any trading decisions based on them.

3. The Inverted Hammer and Shooting Star

The Inverted Hammer and Shooting Star are two candlestick patterns that traders should know. The Inverted Hammer is a bullish reversal pattern that forms after a downtrend. It signals the potential end of the bearish trend as buyers start to enter the market.

On the other hand, the Shooting Star is a bearish reversal pattern that appears after an uptrend. It signifies a possible change in direction as sellers begin to dominate the market.

Both patterns have long upper shadows, small real bodies and little or no lower shadows. However, they differ in their color - Inverted Hammers are typically green or white while Shooting Stars are usually red or black.

It’s important to note that these patterns should be confirmed by other technical indicators before making any trading decisions. Additionally, it's crucial to use proper risk management strategies when trading based on candlestick patterns.

Understanding these unique candlestick formations can provide valuable insights into market sentiment and help traders make informed investment choices during volatile times.

4. The Bullish and Bearish Engulfing Patterns

The Bullish and Bearish Engulfing Patterns are two of the most reliable candlestick patterns used by traders in technical analysis. The pattern is formed when a small candlestick is followed by a larger one that "engulfs" it, hence the name.

In a bullish engulfing pattern, the first candlestick is red or black while the second one is green or white. This indicates that buyers have taken control over sellers, as evidenced by the larger gain on the second day.

On the other hand, a bearish engulfing pattern occurs when a green or white candlestick is followed by a larger red or black one. This suggests that selling pressure has overwhelmed buying pressure and signals potential price declines in future trading sessions.

Traders often use these patterns to determine entry and exit points for their trades. A bullish engulfing formation may be used as confirmation of an uptrend while a bearish engulfing formation could signal potential reversal in an ongoing downtrend.

It's important to note that these patterns do not guarantee success and should always be considered alongside other indicators before making any trading decisions.

5. The Piercing Pattern and the Dark Cloud Cover

The Piercing Pattern and the Dark Cloud Cover are two candlestick patterns that traders use to predict market trends. The Piercing Pattern appears after a downtrend, while the Dark Cloud Cover appears after an uptrend.

The Piercing Pattern is formed when a long red candlestick is followed by a green candlestick that opens below the low of the previous day but closes above halfway up the body of the first day. This pattern suggests that buyers have taken control and could signal an upcoming bullish trend reversal.

On the other hand, the Dark Cloud Cover is formed when a long green candlestick is followed by a red candlestick that opens above but closes below halfway down the body of the previous day's green candle. This pattern indicates potential bearish pressure in future trading sessions.

Traders should note that both patterns require confirmation from subsequent price action before they can be considered valid signals for entering or exiting trades. It's essential to always combine these signals with other technical indicators and analysis tools to make well-informed trading decisions.

6. Candlestick Tweezers

Candlestick tweezers are a popular pattern among traders. The pattern consists of two candlesticks that have the same high or low price point, forming a "tweezer" shape. This pattern can signal potential trend reversals or support and resistance levels.

There are two types of candlestick tweezers: bullish and bearish. A bullish tweezer forms when two candlesticks with the same low price point occur in an established downtrend, while a bearish tweezer occurs when two candlesticks with the same high price point form in an uptrend.

Traders often look for confirmation signals such as volume spikes or additional technical indicators before making trading decisions based on this pattern. Candlestick tweezers can provide valuable insight into market sentiment and potential changes in direction.

It's important to note that no single indicator should be relied upon solely for trading decisions, but rather used in conjunction with other analysis tools for higher accuracy predictions.

7. Three Black Crows and Three White Soldiers

Three Black Crows and Three White Soldiers are two closely related candlestick patterns that can help traders to identify potential reversal points in a trend. The Three Black Crows pattern consists of three long bearish candles that open at or near the high of the previous day, indicating strong selling pressure. This pattern suggests a bearish reversal is likely to occur soon.

On the other hand, the Three White Soldiers pattern consists of three long bullish candles that open at or near the low of the previous day, suggesting strong buying pressure. This pattern indicates a bullish reversal may be on its way.

Traders should look for confirmation from other indicators before making trading decisions based solely on these patterns. It's important to keep in mind that these signals don't always indicate an immediate change in trend but rather suggest caution and further analysis is necessary.

Understanding these candlestick patterns can help traders anticipate market movements and make more informed trading decisions.

8. The Morning and Evening Star

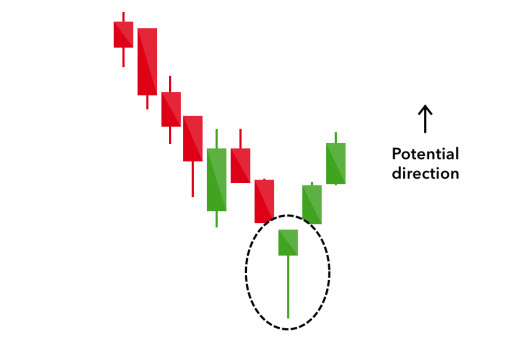

The Morning Star and Evening Star patterns are two important reversal patterns that traders should be familiar with. The Morning Star pattern is a bullish signal, while the Evening Star pattern is bearish.

In the case of the Morning Star pattern, it indicates that a downtrend may be coming to an end. The first candle in this pattern is a long red candlestick, followed by a small-bodied candlestick that gaps lower (the star), and then finishes with a long green candlestick. This shows that sellers were initially in control but lost momentum as buyers started to take over.

On the other hand, the Evening Star pattern suggests that an uptrend may be ending soon. It starts with a long green candlestick, followed by another small-bodied gap up (the star) and ends with a long red candlestick. This signifies that buyers had control at first but then lost steam as sellers took charge.

It's important to note that these patterns should not be relied upon solely for trading decisions. They work best when used in conjunction with other technical indicators such as trend lines or moving averages to confirm signals.

In conclusion, as traders, we are always looking for new ways to improve our strategies and make profitable trades. Understanding candlestick patterns is an essential part of technical analysis that can help us achieve these goals.

By learning the 8 simple candlestick patterns covered in this blog post, you'll be able to identify key market trends and make more informed trading decisions. Whether you're a beginner or an experienced trader, having a solid understanding of these patterns is a valuable tool in your arsenal.

Remember to always do your due diligence and combine candlestick pattern analysis with other indicators for optimal results. And most importantly, never stop learning and refining your skills as a trader.

We hope this article has helped you on your journey towards becoming a successful trader. Keep practicing and honing your skills, and who knows – perhaps one day you'll become the next Warren Buffett!

Comments

Post a Comment