Fibonacci Levels Explained for Better Trade Opportunities

Fibonacci Levels Explained for Better Trade Opportunities

Are you looking for a new way to improve your trading strategies? Have you heard of Fibonacci levels but are unsure of how they work or if they're right for you? Look no further!

In this blog post, we'll explain the power behind the Fibonacci sequence and how it can be used to identify trade opportunities. Whether you're a beginner or an experienced trader, understanding these levels can help take your trades to the next level. So sit back, grab a cup of coffee, and let's dive into the world of Fibonacci levels!

What is the Fibonacci Sequence?

The Fibonacci sequence is a mathematical concept discovered by Leonardo Pisano, also known as Fibonacci. It's a series of numbers where each number is the sum of the two preceding ones: 0, 1, 1, 2, 3, 5, 8... and so on.

This sequence has been found throughout nature and is often referred to as "nature's code." It can be seen in the growth patterns of plants and animals alike. In trading terms, it's used to identify potential levels of support and resistance.

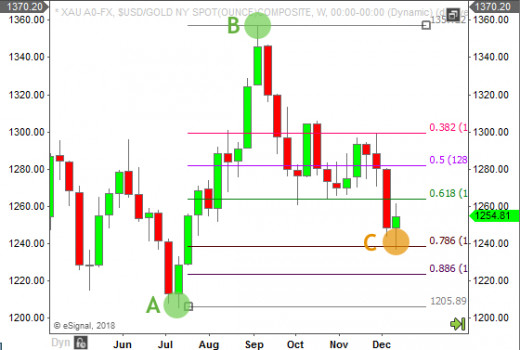

Fibonacci levels are drawn by connecting two points on a price chart - usually from a low point to a high point (or vice versa). These levels are then calculated based on the ratios derived from the Fibonacci sequence: .236,.382,.50,.618,and .786.

Traders use these levels to identify potential entry or exit points for trades. For example, if a stock price falls to one of these key Fibonacci levels after an uptrend or downtrend , traders may see this level as potentially significant support/resistance area where they could buy/sell respectively.

Understanding this simple yet powerful concept can help you improve your trading strategies and take advantage of more opportunities in the market.

How do Fibonacci Levels Work?

Fibonacci levels are a technical analysis tool used to identify potential price levels in financial markets. These levels are based on the Fibonacci sequence, a mathematical formula that has been observed in nature and applied to financial trading.

The Fibonacci sequence is a series of numbers where each number is the sum of the two preceding numbers. For example, 0,1,1,2,3,5...and so on. The ratios derived from these numbers - primarily 38.2%, 50% and 61.8% - are then used as possible support or resistance levels for prices.

Traders use these levels by drawing lines between significant highs and lows in an asset's price history and then identifying potential turning points at key Fibonacci retracement areas (the aforementioned ratios). If prices start to bounce off one of these areas after experiencing momentum in one direction or another, it can signal an opportunity for traders looking to enter or exit positions.

However, it's important to remember that Fibonacci retracements should be used alongside other technical analysis tools and not relied upon exclusively for trading decisions. They're just one piece of the puzzle when making informed trades based on market trends and conditions

Identifying Trade Opportunities with Fibonacci Levels

Fibonacci levels can be an incredibly useful tool for identifying potential trade opportunities. The basic idea is to use the Fibonacci sequence to identify key price levels that may act as support or resistance. By doing so, traders are able to more accurately predict potential price movements and make better-informed trading decisions.

One common strategy is to look for a retracement of the previous trend. For example, if an asset has been in an uptrend and then begins to retrace, traders can use Fibonacci levels to identify potential entry points at which they believe the asset will resume its upward movement.

Another way to use Fibonacci levels is by looking for areas of consolidation or congestion on a chart. These areas often indicate that there are buyers and sellers competing at a particular price level, which means that there may be significant movement once one side gains control. Traders who are able to identify these areas using Fibonacci levels can position themselves accordingly and potentially profit from any subsequent price movements.

Of course, it's worth noting that no trading strategy is foolproof, and there are always risks involved with any type of investment. However, by incorporating Fibonacci analysis into their overall approach, traders can increase their chances of success and potentially improve their returns over time.

Pros and Cons of Trading with Fibonacci Levels

Fibonacci levels can provide valuable information to traders looking for potential entry and exit points in the market. However, like any trading strategy, Fibonacci levels come with their own set of advantages and disadvantages.

One benefit of using Fibonacci levels is that they are widely recognized by traders around the world. This means that there is a large pool of traders who may be more likely to buy or sell at these key levels, which can lead to increased liquidity and potentially better trade execution.

Another advantage of Fibonacci levels is that they can help identify trends and potential reversal points in the market. By analyzing price movements and finding important retracement levels based on Fibonacci ratios, traders can make informed decisions about when to enter or exit a position.

On the other hand, one disadvantage of using Fibonacci levels is that they are not always accurate. Market conditions can change quickly, causing prices to move beyond expected retracement levels. This means that it's important for traders to use other indicators and methods in conjunction with Fibonacci analysis.

Additionally, some critics argue that relying too heavily on technical analysis tools such as Fibonacci retracements can cause traders to overlook fundamental factors affecting the market.

Whether or not you choose to incorporate Fibonacci analysis into your trading strategy will depend on your personal preferences and risk tolerance level. It's important to consider all factors before making any trades based solely on technical analysis tools like Fibonnaci retracements.

In conclusion, Fibonacci levels can be a valuable tool for traders looking to identify potential market trends and opportunities. By understanding the basic principles of the Fibonacci sequence and how it relates to financial markets, traders can use these levels as indicators for potential price movements.

However, it is important to keep in mind that while Fibonacci levels may work well in certain market conditions, they are not foolproof and should never be used as the sole basis for making trading decisions. Traders must always conduct thorough research and analysis before entering into any trade.

By combining technical analysis tools like Fibonacci levels with fundamental analysis and risk management strategies, traders can improve their chances of success in today's fast-paced global financial markets.

Comments

Post a Comment